Ai Tools

Lusha Alternative: Best Contact Data Tools for B2B Sales [2026]

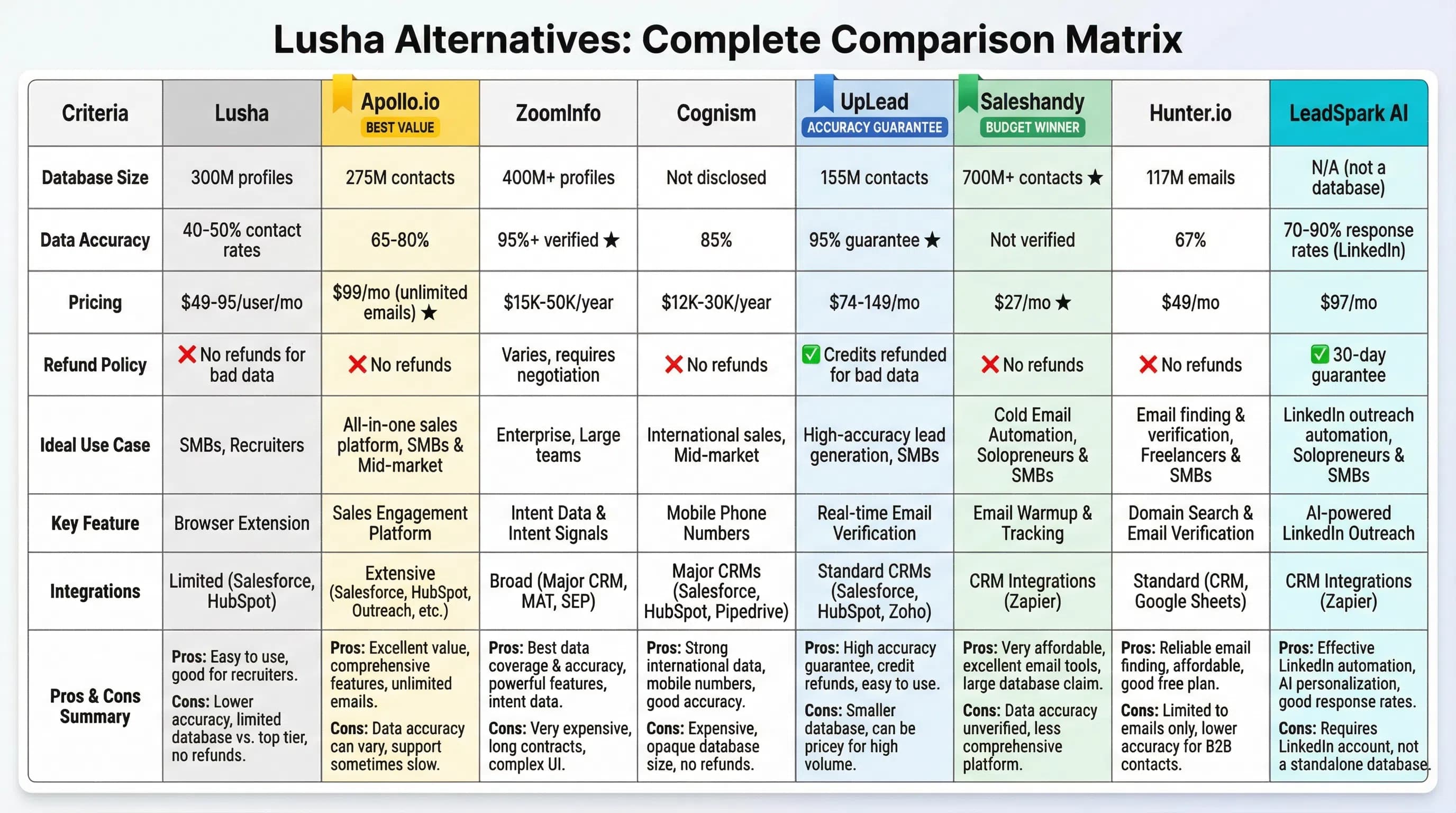

Looking for a Lusha alternative? Compare 8 contact data tools for B2B sales. Features, pricing, accuracy rates, and why LinkedIn-first prospecting beats database hunting.

![Lusha Alternative: Best Contact Data Tools for B2B Sales [2026]](/_next/image?url=%2Fresources%2Flusha-alternative-hero.webp&w=3840&q=75)

LeadSpark AI Team

11 min read

Lusha is one of the most popular contact data tools—but it's not always the best choice.

The biggest complaints? Credits charged even for incorrect data with no refunds, outdated contacts, and 65% of users finding it too expensive. Plus, you're paying for credits that expire if you don't use them.

The good news: there are 8+ Lusha alternatives that offer better accuracy, more affordable pricing, or additional features like email automation and intent data. Some cost 1/5th the price; others offer 95%+ accuracy guarantees with refunds for bad data.

This guide compares the best contact data tools for B2B sales in 2026, with real pricing, accuracy rates, and a decision framework to help you choose the right stack.

Why Sales Teams Are Looking for Lusha Alternatives

Lusha provides access to over 300 million business profiles with direct phone numbers and email addresses via a Chrome extension. It's easy to use—install it, and you're revealing contact information within minutes.

But here's the problem:

1. Credit-Based Pricing Gets Expensive Fast

Lusha uses a credit-based model where you pay for each contact you reveal. The free plan gives you 40 credits/month, and paid plans start at $49/month for additional credits.

The biggest downside is how quickly credits get used up, especially when prospecting at scale. One user noted: "Credits charged even for incorrect data with no option for refunds or credit replacement."

Worse: unused credits are lost if your subscription is downgraded or canceled. You're essentially renting access to contacts that may or may not be accurate.

2. Outdated Contacts Appear Frequently

Reviewers mention finding contacts who have moved to different companies or retired. One sales rep shared: "I've reached contacts who switched jobs 6-12 months ago, and Lusha still showed their old company."

The problem: You're charged credits for outdated data, and there's no refund.

3. Phone Numbers Aren't Classified (Direct Dial vs. Switchboard)

Phone numbers aren't classified as direct dial vs. switchboard, which can lead to wasted time calling general numbers. Users report contact rates of 40-50% for decision-makers, meaning half your credits are wasted.

Some users note 90% accuracy for phone numbers in specific regions, but email accuracy can vary significantly, requiring double-checking.

4. Limited Features Beyond Data

Lusha gives you data—but not what comes next, such as identifying which leads are high intent or who should own them. You'll need separate tools for:

- Email sequencing and outreach

- Intent data and buyer signals

- Enrichment and company intelligence

- LinkedIn prospecting

Many Lusha alternatives offer these features built-in, saving you from managing multiple tools.

5. Pricing Doesn't Always Align with Value

Out of reviews focused on affordability, 65% of reviewers find the platform to be too expensive, and only 13% find it affordable. Enterprise licenses cost around $95/user/month when billed annually, though Lusha now offers unlimited credit plans at this tier.

For teams making 100+ prospecting touchpoints per week, credit costs add up fast.

The 8 Best Lusha Alternatives for B2B Sales

Here are the top contact data platforms, organized by use case and budget.

1. Apollo.io: Best All-in-One Alternative for Budget-Conscious Teams

What it does: Combines 275M+ contacts with email sequencing and engagement automation in one platform.

Key features:

- 275 million contacts and 60 million companies

- Email and phone data with 65-80% accuracy

- Multi-channel sequences (email, calls, LinkedIn)

- Built-in dialer and email sender

- Free tier with limited credits

Pricing: Free tier available; paid plans from $99/month (unlimited emails)

Best for: Small to mid-sized teams wanting data + outreach in one tool

The reality: Apollo's data accuracy clusters around 65-80% vs. ZoomInfo's 95%+, but at 1/10th the price. One user noted: "While ZoomInfo's $35K package was too much, Apollo's $99/month plan paid for itself".

Apollo excels at providing an affordable all-in-one solution with transparent pricing and built-in outreach capabilities. Unlike Lusha's credit model, Apollo's paid plans offer unlimited emails.

Lusha vs. Apollo:

- Lusha: Credit-based, expires if unused, no outreach features

- Apollo: Flat monthly fee, unlimited emails, built-in sequences

2. ZoomInfo: Best for Enterprise Teams Requiring Maximum Accuracy

What it does: Industry-leading B2B database with 400+ million contact profiles and 110 million company profiles.

Key features:

- 95%+ verified accuracy with <5% bounce rates

- Intent data showing which accounts are actively researching

- Technographics (what tools companies use)

- Direct dial and mobile numbers

- Org charts and buying committee mapping

Pricing: Custom pricing; typically $14,995-$50,000 annually (no public pricing, annual contracts required)

Best for: Enterprise sales teams (50+ reps) with 6-12 month sales cycles

The reality: ZoomInfo has the best data hands down, especially for U.S. direct phone numbers. However, its high cost prompts teams to explore more budget-conscious options.

One user reported: "I previously used ZoomInfo and saw contact accuracy rates of around 50%, but when I tested Cognism's data, I recorded accuracy of around 85%" — accuracy varies by region and industry.

Lusha vs. ZoomInfo:

- Lusha: 300M profiles, $49-95/user/mo, 40-50% contact rates

- ZoomInfo: 400M+ profiles, $15K+/year, 95%+ accuracy, enterprise-focused

3. Cognism: Best for GDPR-Compliant Global Prospecting (Especially EMEA)

What it does: Globally compliant B2B database with phone-verified data and Diamond Data® mobile numbers.

Key features:

- GDPR and CCPA compliance built-in

- Do-Not-Call (DNC) screening across 13 countries

- Data accuracy of around 85%

- Strong EMEA coverage (better than U.S.-focused tools)

- Intent data and technographics

Pricing: Custom pricing; typically $12K-30K annually

Best for: Global teams selling into European or regulated markets

The reality: Cognism applies DNC screening across a broader set of national registers, embedding consent management directly into outbound workflows. This reduces regulatory exposure—critical for GDPR compliance.

Cognism is fantastic for regulated industries and global teams, though some reviewers report its U.S. data can lag behind ZoomInfo.

Lusha vs. Cognism:

- Lusha: GDPR-compliant but no DNC screening, global coverage

- Cognism: DNC screening in 13 countries, 85% accuracy, EMEA strength

4. Saleshandy Lead Finder: Best for Massive Database Access

What it does: B2B contact database with 700M+ verified contacts from 160+ countries.

Key features:

- 700M+ B2B contacts (largest database among alternatives)

- AI Lead Search with natural language prompts

- Email verification and bounce protection

- Integrates with Saleshandy's email automation platform

- Bulk export capabilities

Pricing: From $27/month (part of Saleshandy cold email plans)

Best for: Teams wanting the largest possible database at an affordable price

The reality: Saleshandy combines contact data with email automation, making it a Lusha alternative that also handles outreach. The AI Lead Search feature lets you describe your target audience in plain text rather than filtering manually.

At $27/month, it's one of the most affordable alternatives—though data accuracy isn't independently verified like ZoomInfo or Cognism.

Lusha vs. Saleshandy:

- Lusha: 300M profiles, $49+/mo, credits expire

- Saleshandy: 700M+ contacts, $27/mo, includes email automation

5. UpLead: Best for Guaranteed Data Accuracy

What it does: B2B database with 155 million contacts and a 95% data accuracy guarantee.

Key features:

- 95% data accuracy guarantee — refunds credits for bounced contacts

- 155M+ contacts with email and phone data

- Real-time email verification

- Technographics and firmographics

- Chrome extension for LinkedIn prospecting

Pricing: From $74/month (170 credits) to $149/month (400 credits)

Best for: Teams prioritizing accuracy over database size

The reality: UpLead refunds any bounced contacts, solving Lusha's biggest problem: paying for bad data. The 95% accuracy guarantee means you only pay for verified contacts.

The trade-off: smaller database (155M vs. Apollo's 275M or Saleshandy's 700M), but higher confidence in data quality.

Lusha vs. UpLead:

- Lusha: No refunds for bad data, 40-50% contact rates

- UpLead: 95% accuracy guarantee, refunds for bounces

6. Hunter.io: Best Budget Option for Email Finding

What it does: Email finder and verifier with 117 million B2B email addresses.

Key features:

- Email finder from company domains

- Email verification and deliverability scoring

- Chrome extension for quick lookups

- Domain search for finding all emails at a company

- Free tier with 25 searches/month

Pricing: Free tier available; paid plans from $49/month

Best for: Solo SDRs or freelancers needing basic email finding

The reality: Hunter.io is email-only—no phone numbers. Data accuracy is around 67% vs. competitors' 91-98%, but it's one of the most affordable options.

Use Hunter.io for email discovery, then verify with a tool like UpLead or Saleshandy before outreach.

Lusha vs. Hunter.io:

- Lusha: Emails + phone numbers, 300M profiles, $49-95/user/mo

- Hunter.io: Emails only, 117M addresses, $49/mo total (not per user)

7. Kaspr: Best LinkedIn Chrome Extension Alternative

What it does: LinkedIn-focused contact finder with phone and email enrichment.

Key features:

- Chrome extension for LinkedIn prospecting

- Phone and email data extraction

- GDPR-compliant with DNC filtering

- Integrates with CRMs and outreach tools

- Free tier with 5 credits/month

Pricing: Free tier; paid plans from $65/month (unlimited B2B emails, 200 phone credits)

Best for: Sales teams prospecting primarily on LinkedIn

The reality: Kaspr is considered good for LinkedIn prospecting with GDPR compliance built-in. It's similar to Lusha's Chrome extension approach but with more transparent pricing.

The limitation: focused on LinkedIn, so if you need broader prospecting (company searches, filters, etc.), Apollo or ZoomInfo are better fits.

Lusha vs. Kaspr:

- Lusha: Multi-source data (LinkedIn, web, databases), broad coverage

- Kaspr: LinkedIn-focused, GDPR-compliant, $65/mo with unlimited B2B emails

8. LeadSpark AI: Best LinkedIn-First Prospecting (Not a Database)

What it does: AI-powered LinkedIn prospecting and personalization tool—not a contact database.

Key features:

- Analyzes LinkedIn profiles, recent posts, and activity

- Generates hyper-personalized conversation starters

- Real-time research on job changes and company news

- Multi-channel context (LinkedIn + email + calls)

- 70-90% response rates (vs. cold emails at 5.1%)

Pricing: From $97/month

Best for: SDRs prioritizing LinkedIn outreach and relationship-building

The reality: LeadSpark AI isn't a Lusha alternative—it's a complement. Use contact data tools (Apollo, ZoomInfo, Lusha) to find prospects, then use LeadSpark AI to craft personalized LinkedIn outreach that actually gets replies.

The difference: Contact databases give you who to contact. LeadSpark AI tells you what to say based on what they care about.

While Lusha gets you 40-50% contact rates on phone calls, LinkedIn-first personalization achieves 70-90% response rates because you're starting conversations based on shared interests, recent posts, and real context—not cold pitches.

Lusha vs. LeadSpark AI:

- Lusha: Contact data tool (emails, phones)

- LeadSpark AI: LinkedIn personalization tool (conversation starters, context)

- Best combo: Lusha/Apollo for contact data + LeadSpark AI for personalized outreach

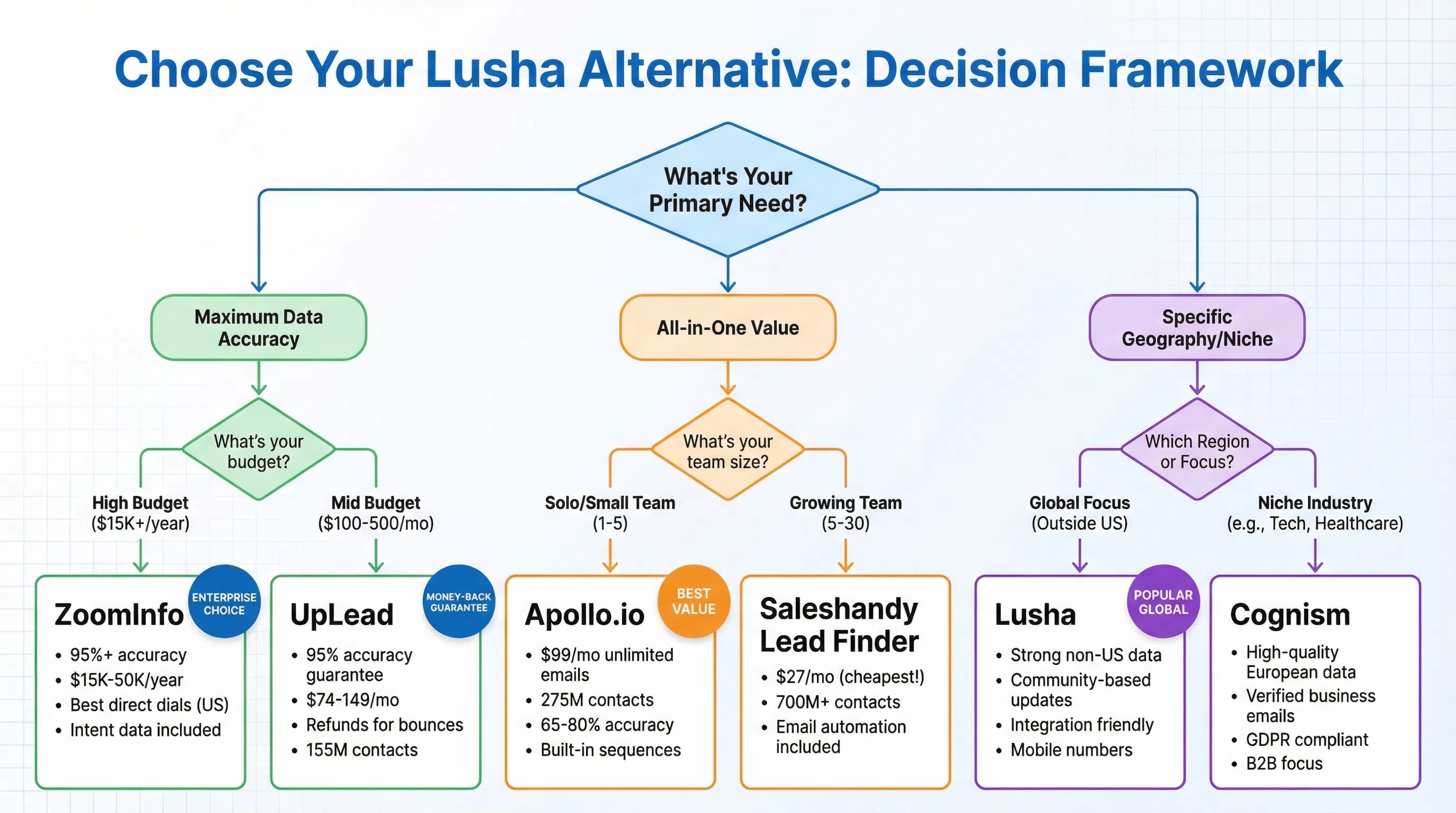

How to Choose the Right Lusha Alternative

Don't just pick the cheapest or most popular tool. Follow this framework:

Step 1: Define Your Primary Use Case

Need phone numbers? → ZoomInfo (best direct dials), Lusha (solid mobile coverage), Cognism (GDPR-compliant)

Need emails only? → Hunter.io ($49/mo), Saleshandy ($27/mo)

Need all-in-one (data + outreach)? → Apollo.io ($99/mo with unlimited emails)

Global/EMEA prospecting? → Cognism (DNC screening, GDPR), Kaspr (LinkedIn + GDPR)

LinkedIn-first strategy? → LeadSpark AI for personalization + Apollo/Lusha for contact data

Guaranteed accuracy? → UpLead (95% guarantee with refunds), ZoomInfo (95%+ accuracy)

The best tool depends on what data you need and how you'll use it.

Step 2: Calculate Cost Per Contact (Not Just Monthly Price)

Don't compare monthly fees—compare cost per usable contact.

Example:

- Lusha: $95/user/mo enterprise, 40-50% contact rate = ~$2-3 per successful contact

- Apollo: $99/mo, 70% accuracy, unlimited emails = ~$0.50 per successful contact

- ZoomInfo: $15,000/year, 95% accuracy = ~$1-2 per contact (high volume teams)

- LeadSpark AI: $97/mo, 80% response rate on LinkedIn = ~$0.40 per response

Calculate: (Monthly cost ÷ Contacts used) ÷ Accuracy rate = Cost per usable contact

Step 3: Consider Your Tech Stack Integration

The best data tool integrates with your existing workflow:

- CRM native integration: Salesforce, HubSpot, Pipedrive

- Sales engagement platforms: Outreach, Salesloft, Reply.io

- Two-way sync: Data flows automatically, no manual exports

Apollo offers broad integrations with most CRMs and SEPs. ZoomInfo integrates deeply with enterprise stacks. Lusha offers seamless CRM integrations but limited SEP support.

Step 4: Test Accuracy in Your Target Market

Data accuracy varies by:

- Geography: ZoomInfo excels in North America; Cognism leads in EMEA; Apollo provides consistent global data

- Industry: Tech startups vs. enterprise vs. healthcare

- Job titles: C-level vs. mid-management vs. individual contributors

Run a trial with 50-100 contacts in your ICP. Measure:

- Email bounce rate (should be <5%)

- Phone connect rate (should be >50% for direct dials)

- Job title accuracy (how many contacts match your target?)

Don't trust marketing claims—test with your actual target market.

Step 5: Budget-Conscious Stack Recommendations

Solo SDR/Freelancer ($50-150/month):

- Apollo.io Free (unlimited emails, limited credits)

- Hunter.io Starter ($49/mo for emails)

- LeadSpark AI Founder ($49/mo for LinkedIn personalization)

Small Team 2-10 SDRs ($100-500/month):

- Apollo.io Pro ($99/mo per user) OR Saleshandy ($27/mo per user)

- LeadSpark AI ($97/mo per user)

- LinkedIn Sales Navigator ($99/mo)

Mid-Market 10-50 SDRs ($1K-5K/month):

- Apollo.io + UpLead (for accuracy guarantee)

- Cognism (if selling into EMEA)

- LeadSpark AI for LinkedIn personalization

- Sales engagement platform (Reply.io or Salesloft)

Enterprise 50+ SDRs ($10K+/month):

- ZoomInfo (best data accuracy, intent data)

- Cognism (global compliance)

- LeadSpark AI (enterprise plan)

- Outreach or Salesloft (SEP orchestration)

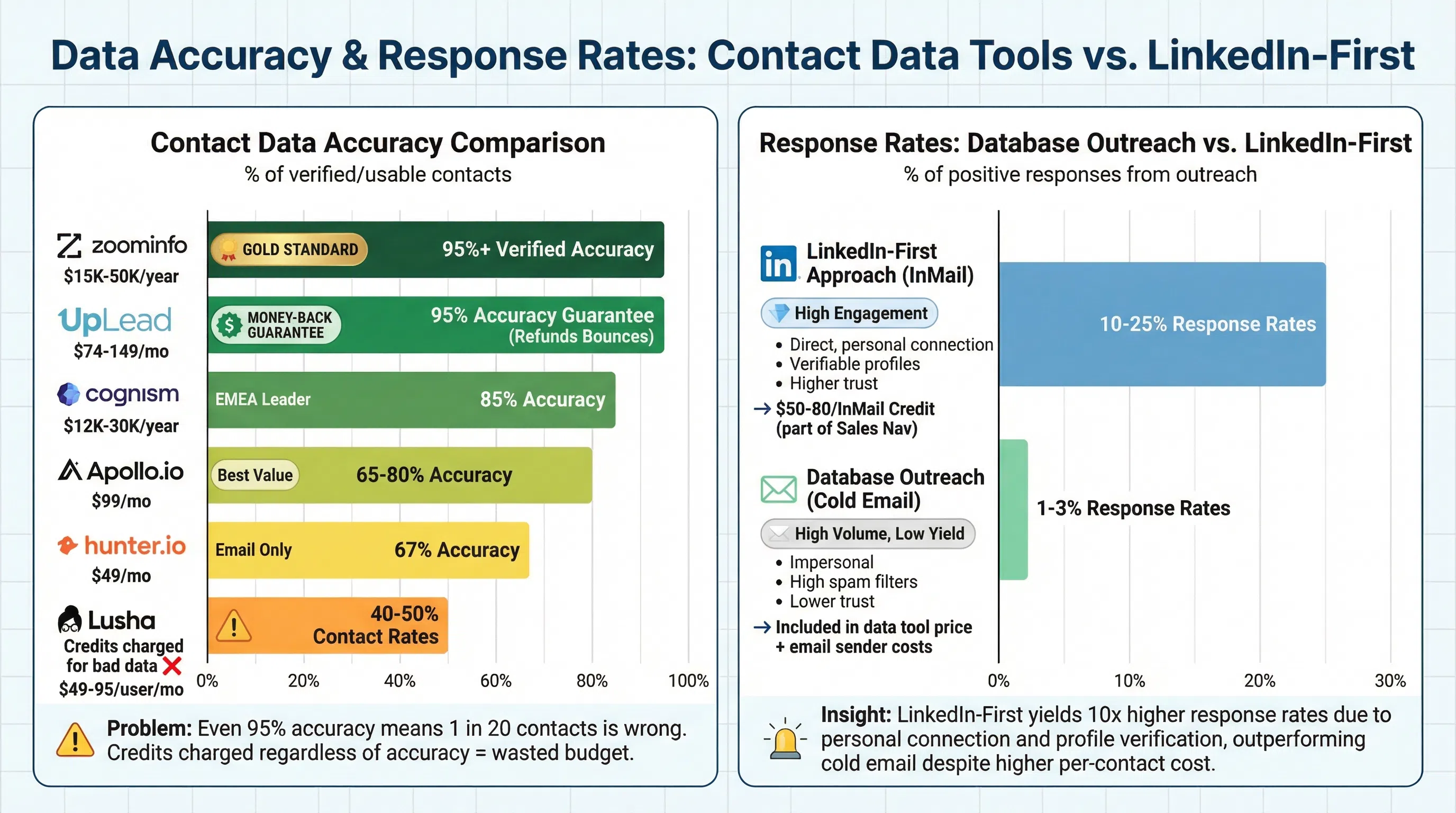

The Future of Contact Data: LinkedIn-First Beats Database Hunting

Here's the uncomfortable truth about contact databases in 2026:

Cold outreach using databases is declining:

- Email-only outreach: 5.1% average response rates (down from 8-10% in 2020)

- Phone cold calling: 40-50% contact rates, but <10% convert to meetings

- Database accuracy: Even the best (ZoomInfo at 95%) means 1 in 20 contacts is wrong

LinkedIn-first prospecting is winning:

- LinkedIn response rates: 70-90% with personalized messaging

- Higher-quality conversations (you can see their activity, posts, interests)

- No database decay—LinkedIn profiles are self-updated

- Compliance-friendly (public profile data, no GDPR concerns)

The shift: Top SDRs use contact databases to identify targets, then lead with LinkedIn personalization rather than blasting emails.

Winning strategy in 2026:

- Find contacts: Apollo/ZoomInfo/Cognism (who to reach)

- Research context: LeadSpark AI (what they care about)

- Lead with LinkedIn: Personalized connection requests and InMails

- Follow up with email: After LinkedIn relationship is established

This approach combines the best of both worlds: database scale + LinkedIn personalization.

FAQs

Is Lusha worth the money in 2026?

Lusha is worth it for teams needing quick phone number lookups with a simple Chrome extension. However, 65% of users find it too expensive due to credit-based pricing and no refunds for bad data. Alternatives like Apollo ($99/mo unlimited emails), UpLead (95% accuracy guarantee), or Saleshandy ($27/mo) offer better value for most teams.

What is the most accurate alternative to Lusha?

ZoomInfo offers 95%+ verified accuracy but costs $15K-50K/year. For budget-conscious teams, UpLead provides a 95% data accuracy guarantee with refunds for bounced contacts at $74-149/month—much more affordable than ZoomInfo.

Can I get contact data for free?

Yes. Apollo.io offers a free tier with unlimited emails (limited credits for phone numbers). Hunter.io provides 25 free searches/month. Kaspr offers 5 free credits/month. These free tiers work well for solo SDRs or low-volume prospecting, but you'll need paid plans for scale.

What's better: Lusha or Apollo?

Apollo is better for most teams because it combines contact data with email sequencing and automation at $99/month (flat fee, unlimited emails). Lusha uses credit-based pricing that adds up fast. Apollo's data accuracy is 65-80% vs. Lusha's 40-50% contact rates, and Apollo includes outreach tools Lusha lacks.

Do contact data tools work for LinkedIn prospecting?

Contact data tools provide emails and phone numbers, but LinkedIn prospecting requires different tools. Use:

- LinkedIn Sales Navigator ($99-149/mo) for advanced search and InMail

- LeadSpark AI ($97/mo) for AI-powered personalization based on profiles and posts

- Contact databases (Apollo, Lusha) as supplements for email/phone after LinkedIn connection

LinkedIn-first approaches achieve 70-90% response rates vs. cold email's 5.1%.

How do I avoid paying for bad data?

Choose tools with accuracy guarantees:

- UpLead: 95% accuracy guarantee, refunds bounced contacts

- Saleshandy: Email verification built-in

- ZoomInfo: 95%+ accuracy (expensive but reliable)

Avoid Lusha's biggest problem: credits charged even for incorrect data with no refunds. Always test tools with a trial in your target market before committing.

Should I use multiple contact data tools?

Yes, if budget allows. The "waterfall enrichment" strategy:

- Start with Apollo Free (unlimited emails, basic data)

- Use UpLead for contacts Apollo doesn't have (95% guarantee)

- Use ZoomInfo or Cognism for high-value enterprise targets (best accuracy)

- Use LeadSpark AI for LinkedIn personalization (not a database)

This maximizes coverage while controlling costs—cheap tools first, premium tools for high-value prospects.

Is LinkedIn prospecting better than buying contact data?

LinkedIn-first prospecting delivers 70-90% response rates vs. database cold outreach at 5.1%. The advantage: you can see prospects' recent posts, interests, and activity—enabling truly personalized messaging.

The trade-off: LinkedIn prospecting is slower (manual research) vs. database bulk exports. Best approach: Use contact databases to identify targets, then lead with personalized LinkedIn outreach using tools like LeadSpark AI.

Choose Your Lusha Alternative (Or Build a Better Stack)

Lusha isn't a bad tool—it's just not the best fit for every team. If you're frustrated by credit-based pricing, outdated contacts, or limited features, there are better alternatives:

Best for budget: Apollo.io ($99/mo, all-in-one)

Best for accuracy: ZoomInfo ($15K+/year, 95%+ verified) or UpLead ($74/mo, 95% guarantee)

Best for EMEA/global: Cognism ($12K-30K/year, GDPR-compliant)

Best for LinkedIn: LeadSpark AI ($97/mo, 70-90% response rates)

Best for email-only: Hunter.io ($49/mo) or Saleshandy ($27/mo)

Most importantly: Don't rely solely on contact databases. The future of B2B prospecting is LinkedIn-first personalization—using databases to identify targets, then crafting conversations based on what prospects actually care about.

Try LeadSpark AI to see how LinkedIn-first personalization achieves 70-90% response rates by analyzing profiles, posts, and activity—not just blasting generic emails to purchased lists.

Sources:

- 7 Best Lusha Alternatives - TrulyInbox

- 10 Lusha Alternatives - Cognism

- Lusha Alternatives 2026 - Sparkle

- Lusha Alternatives - ZoomInfo

- Lusha Alternatives - Default

- Lusha Alternatives - Saleshandy

- Lusha Review 2026 - La Growth Machine

- Lusha Reviews - G2

- Lusha Pricing Review - Cognism

- Lusha Review - RB2B

- Best B2B Contact Database Platforms - ZoomInfo

- Apollo vs ZoomInfo Comparison - Fundraise Insider

- Cognism vs ZoomInfo - Cognism

- Apollo Pricing vs Alternatives - SalesIntel

- Apollo vs ZoomInfo vs Lusha - TheAISurf

Ready to Generate Personalized Icebreakers?

Join sales professionals using LeadSpark AI to create hyper-personalized LinkedIn icebreakers in minutes.